Vat Registration Saudi Arabia

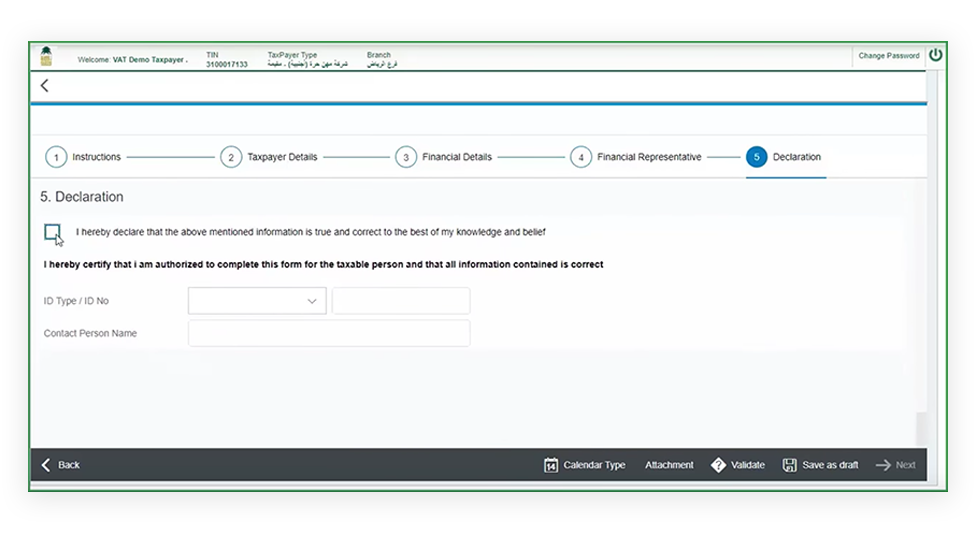

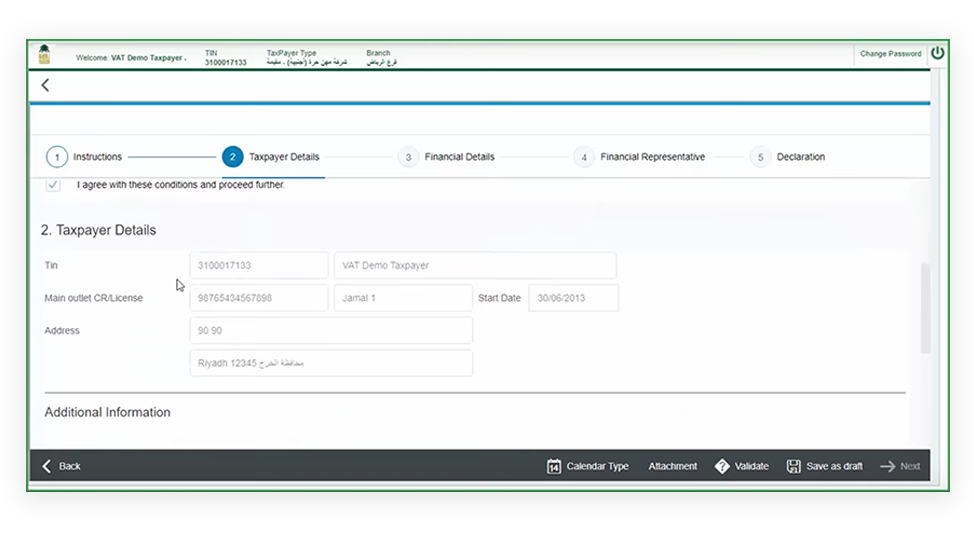

All non resident taxable persons must have one tax representative established in saudi arabia and who is approved by gazt.

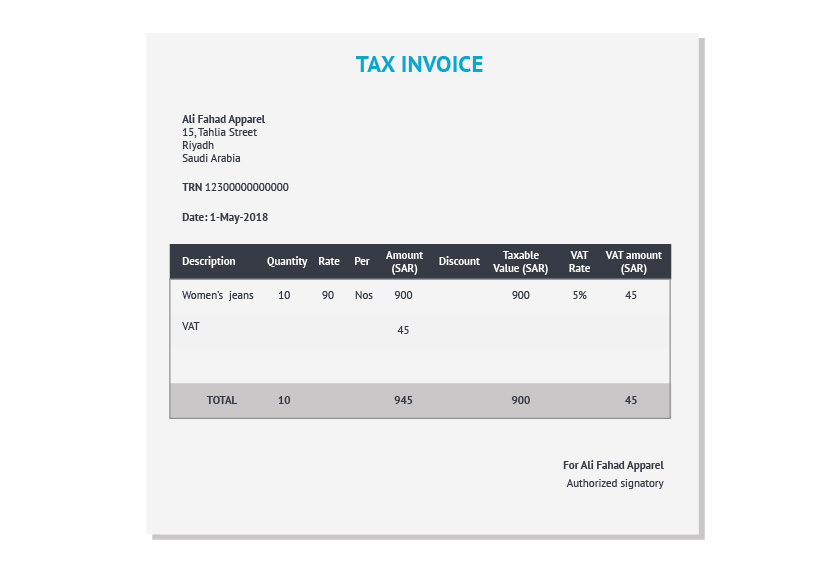

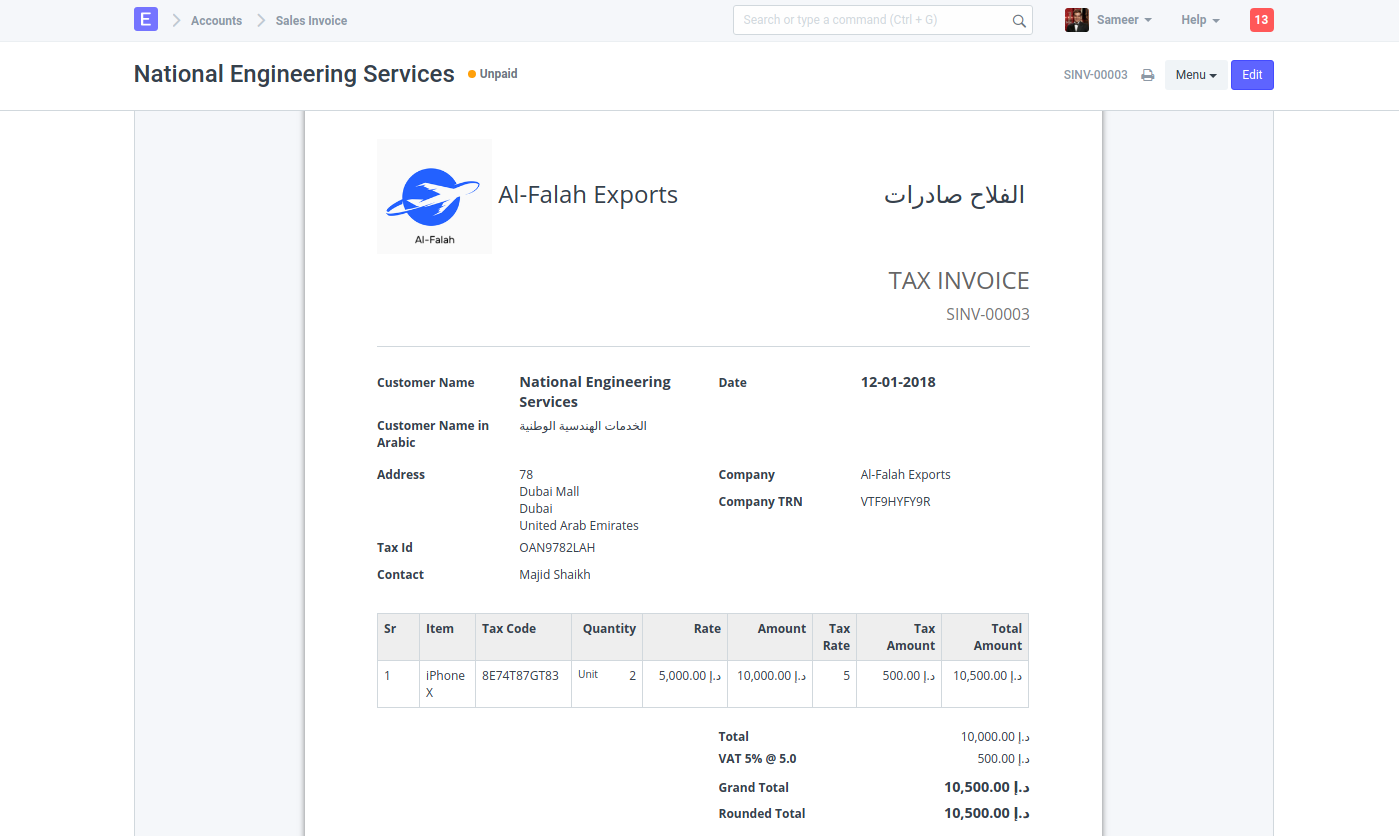

Vat registration saudi arabia. Vat is applied in more than 160 countries around the world as a reliable source of revenue for state budgets. Individuals registration economic activities. A service that enables the public and authorities to verify that beneficiaries have registered in the vat and received a registration certificate. Non residents who carry on economic activities but have no fixed place of business or fixed establishment in saudi arabia are required to register if they should pay vat in saudi arabia.

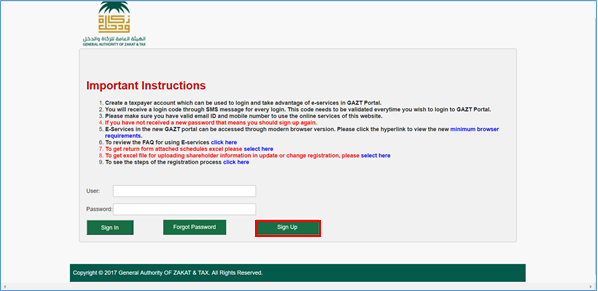

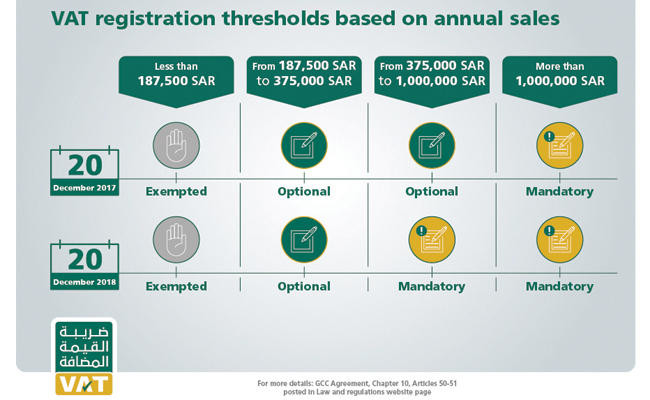

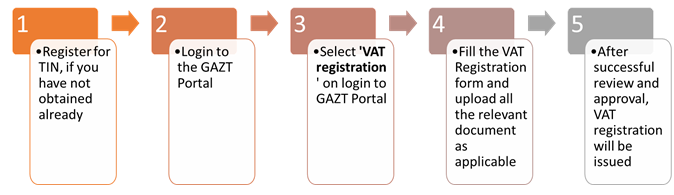

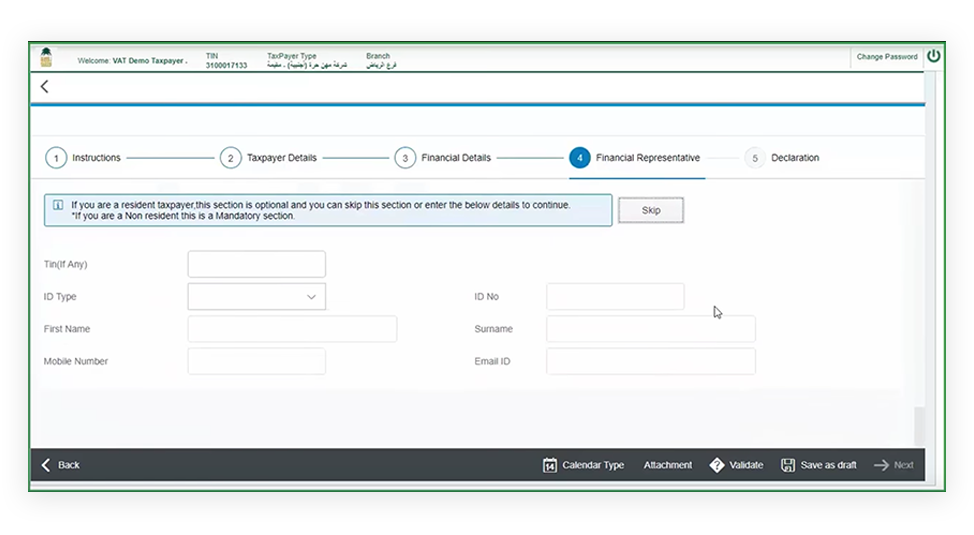

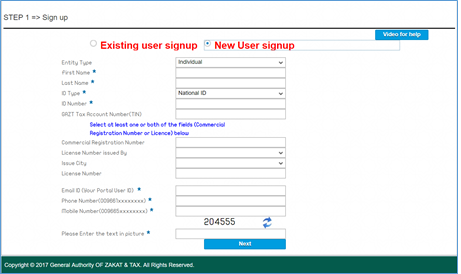

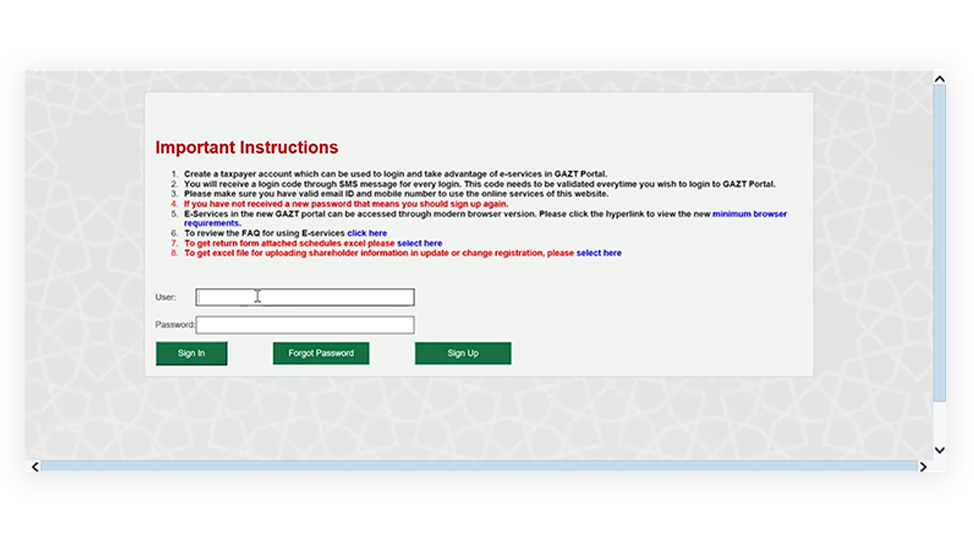

In saudi vat not all businesses who are operating in kingdom are required to register. On the basis of the annual value of taxable supplies the registration deadlines are published by gazt. The ksa vat implementing regulations defines a threshold for vat registration. Steps to complete the service enter the authority portal.

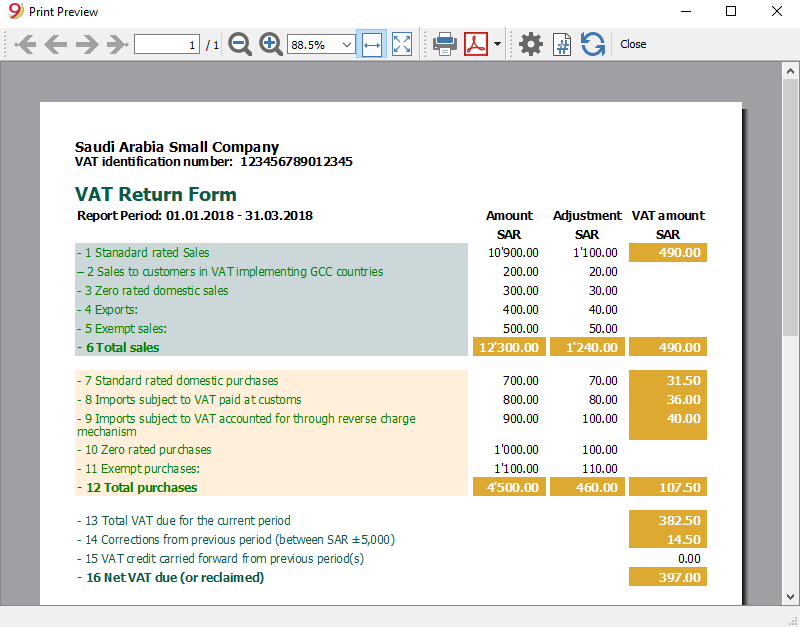

Value added tax vat value added tax or vat is an indirect tax imposed on all goods and services that are bought and sold by businesses with a few exceptions. The vat registration threshold defined is on the basis of the annual value of supplies made or expected to be made by the business.